Texas Oil & Gas Industry – Down, Not Out

THE OIL AND GAS INDUSTRY is big in Texas. So, despite the promise of the Permian and the shine of the Eagle Ford, it comes as no surprise that The Lone Star State is feeling the blow of the two-years-and-counting industry downturn. For those not following the happenings as closely as folks who live and breathe (and swelter in) Texas, I’ve rustled up some statistics that may help paint the picture.

This May, Texas bankruptcy courts passed Delaware in terms of cumulative debt administered, according to Haynes and Boone LLC. The firm’s latest Oil Patch Bankruptcy Monitor, dated May 31, counted 41 E&P bankruptcies-representing nearly $24.3 billion in cumulative secured and unsecured debt-filed in Texas since 2015, putting the state in the unenviable top spots for volume and debt by Haynes and Boone calculations.

The largest of the Texas filings was that of LINN Energy. The company filed voluntary petitions for restructuring under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas in May. In fact, Texas Alliance of Energy Producers, the nation’s largest state association of independent oil and gas producers, noted in its May newsletter that LINN’s $10 billion debt made the company’s bankruptcy “the biggest among energy companies so far in this downturn.”

Tough times for companies mean tough times for employees. Job losses across the state have been dramatic. According to the Texas Petroleum Index (TPI), a service of the Texas Alliance of Energy Producers, the number of jobs trimmed from upstream oil and gas company payrolls in Texas surpassed 100,000 in May 2016, declining to 205,100 from a peak of about 306,020 in December 2014. “The last time industry employment was this low was in late 2010, as the last expansion of upstream oil and gas activity in Texas was just beginning to take off,” said Karr Ingham, the economist who created the TPI, in a June 27 update.

And while it’s likely cold comfort, the job losses actually pale in comparison to those of the late 1980s. A straight comparison of the current downturn to the industry bust of the 1980s is hard to formulate, but it’s estimated that job losses in the industry reached somewhere near 240,000 in Texas alone during that time, John Graves of Graves & Co. told Bloomberg in a late fall 2015 interview.

Considering drilling activity in Texas has declined more than 80%, Ingham said it’s a “minor miracle” that only about 32% of jobs have been cut since December 2014.

So about that drilling activity…the monthly average of active drilling rigs in April 2016 declined to less than 200 for the first time since June 1999. The rig count continued downward in May, despite higher crude oil prices. The Baker Hughes count of active drilling rigs in Texas averaged 182, 51.5% fewer units than in May 2015 when an average of 375 rigs were working. According to Baker Hughes calculations, the Texas rig count as of June 3 was 176, down almost 81% from the weekly count in November 2014-the count just before rigs began to drop.

The Railroad Commission of Texas (Commission) issued a total of 606 original drilling permits inMay 2016 compared to 916 in May 2015. The May total included 488 permits to drill new oil or gas wells, 13 to re-enter plugged well bores and 105 for re-completions of existing well bores. The breakdown of well types for those permits issued May 2016 included 179 oil, 28 gas, 354 oil or gas, 17 injection, zero service and 28 other permits.

In May 2016, Commission staff processed 760 oil, 199 gas, 60 injection and 11 other completions compared to 1,299 oil, 201 gas, 72 injection and seven other completions in May 2015. Total well completions for 2016 year to date are 5,529 down from 9,832 recorded during the same period in 2015.

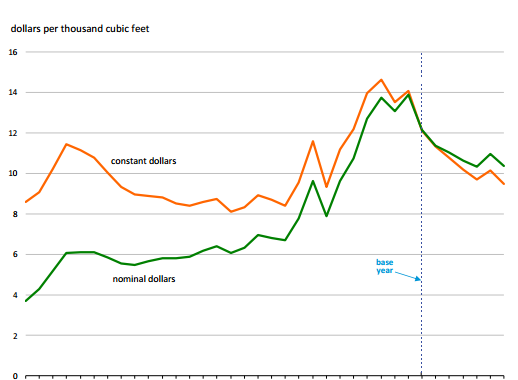

Now all that said, the price of WTI has inched steadily upward, resting just above $46/bbl in late June.

“It appears increasingly likely that we have seen the bottom, and that is certainly cause for some celebration and cautious optimism about where we are headed at this point,” Ingham said in May, noting that just as it took time for these indicators to trend downward following the fall of crude oil prices, positive changes will likely take several months to appear following the price uptick.

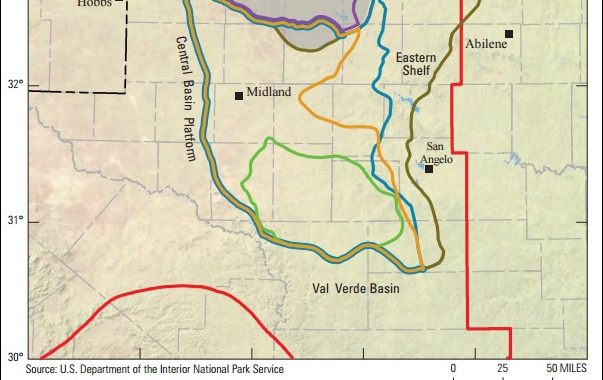

But if you’re looking for positivity – and who isn’t? – keep one eye on The Lone Star State. Remember those 176 rigs I mentioned? Those rigs represent roughly 43% of all active rigs in the US. Many producers looking to put rigs back to work are targeting the Permian. Exceeding all other districts in Texas, the Midland district saw 221 original drilling permits issued and 304 completions processed by the Commission in May. Texas may be down, but it is certainly not out.