There’s a Black Gold Rush Happening in America

The so-called hunt for yield is causing a “black gold rush” into one of America’s richest oilfields, according to Citi analyst Scott Gruber.

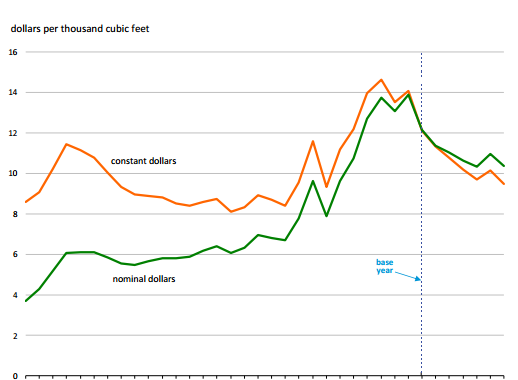

Because interest rates and bond yields have been low, investors everywhere have been searching for the next best investing opportunity to increase their chances of a bumper return.

And in their search, “investors have plowed money into private equity funds who have turned to their old friend, oil and gas, for the prospect of outsized returns,” Gruber and his team wrote in a note on Tuesday.

US exploration and production companies, or E&Ps, have raised $18 billion in equity this year, according to FactSet data cited by Gruber. Half of that amount was raised in the high-quality Permian Basin, which includes parts of Texas and New Mexico. Meanwhile, the E&Ps have found ways to drill oil more efficiently.

“The combination has spurred acreage values higher in the Permian which has incented some privates to sell or initiate the IPO process,” Gruber wrote.

“In turn, this has spurred public E&Ps to issue equity to be earlier in the capital raise queue and/or raise funds to develop newly acquired acreage, ultimately taking advantage of the same thirst for yield.”

The gains in acreage or land values have in turn improved the valuations of oil explorers in the Permian Basin.

Private E&Ps, particularly in the Permian Basin, have accounted for nearly 80% of the recent gains in the oil rig count. As of Friday, the US oil rig count had gained in 10 out of the past 11 weeks, the longest streak since before oil crashed two years ago, according to the drilling giant Baker Hughes.

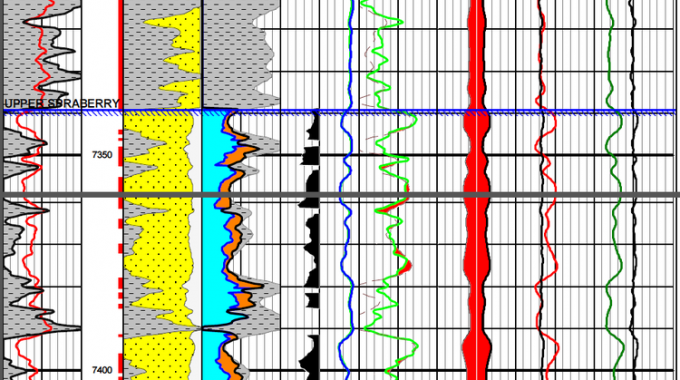

However, the count of the more efficient horizontal oil rigs in the Permian Basin is still 53% below its peak, Citi estimated.